When calculating Sales Team’s Costs the company, the usual approach is employer cost. However, it is essential for a “sustainable business model” that companies include the costs that are actually incurred but not taken into account.

This article has been prepared for company owners or managers – whose specialty is not payroll or accounting – to predict the average cost of a staff member with a certain deviation.

These scales and figures will definitely come in handy when you are on a deserted island with no internet access and no accountant who has fallen on the island with you 😊

Let’s explain this with examples for an employee cost who receives a net salary of 30.000 TL and is allocated a vehicle for his job.

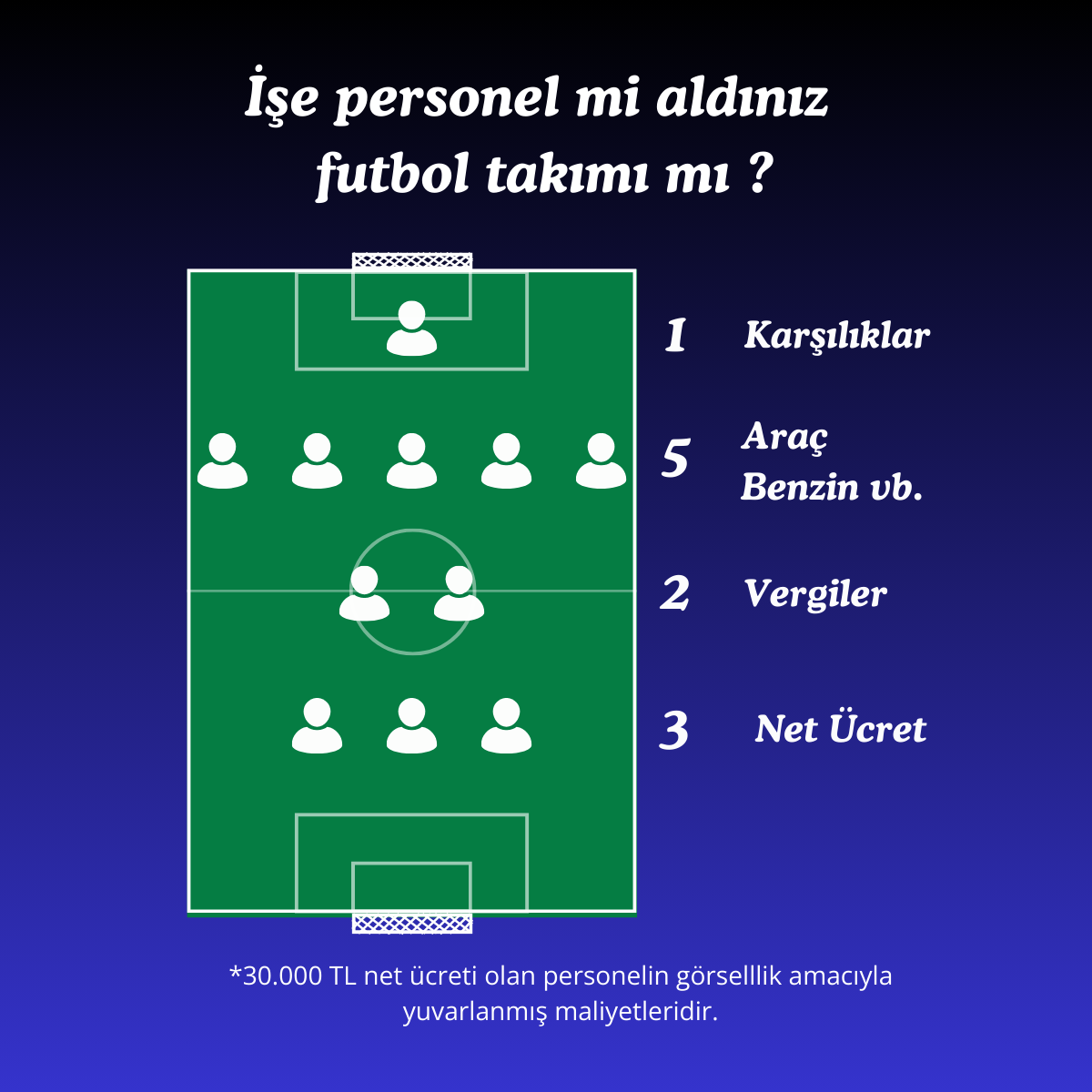

1-Net Salary = 30,000 TL (+ 3 Units)

This is a figure, that does not need to be calculated and is the figure excluding the payments you say you will pay to your staff, such as meals, premiums, etc.

2-Taxes = 18.166 TL ( + 2 Units)

Employee Tax shares -> Employee SSI, Employee Unemployment Tax, Income Tax, Stamp Duty

Employer Tax Shares -> Employer SSI, Employer Unemployment Tax

3-Other Employee Costs (Excluding VAT) = 48.471 TL (+ 5 Units)

Based on modest figures. A/B type zero-equipped vehicle, the cheapest cell phone package, daily meal fee within the tax exemption limit.

Vehicle Rent 40.000 TL

Gasoline (45 liters x 3 tanks) 4,381 TL

Cell Phone monthly package 350 TL

Meal Card (170 TL per day x 22) 3,740 TL

4- Provisions = TL 14.127 (+1 Unit)

Provisions are a budget that is not taken into account in 99% of companies, subject to a pay-as-you-go approach. However, when you examine these costs in detail below, you can see that there is an expense item that is certain to occur. It is financially wrong not to include these figures in your costs. To summarize :

1.Unused Annual Leave

It is paid vacation that every employee cannot use due to workload. It is paid regardless of the way of leaving the job. It is a definite cost and a 7-day provision is made.

2.Severance payment

This is the budget allocated for staff whose employment contract is terminated/retired or whose spouse do not alllow her wife to work. Personnel are entitled to seniority up to the ceiling for severeance for each year of employment. For this reason, a provision of 1/12 of the monthly gross cost has been set aside.

3.Notice payment

It is the figure that will be realized no matter how the staff leaves in accordance with the labor law. The gross cost for 4 weeks is divided by 12 and allocated for each month.

4.Re-employment compensation

In a company of 100 people, it is calculated with the assumption that 1 person has won a re-employment case. In a company of 100 employees, this is a figure that will definitely be realized. Provision is allocated as 1% of the gross cost.

To summarize; when calculating sales team’s costs, a staff you pay 3 units as a net salary; you need to allocate a budget of 11 units, which is the number of players in a football team, including 2 units of tax, 5 units of other expenses and 1 unit of provisions .

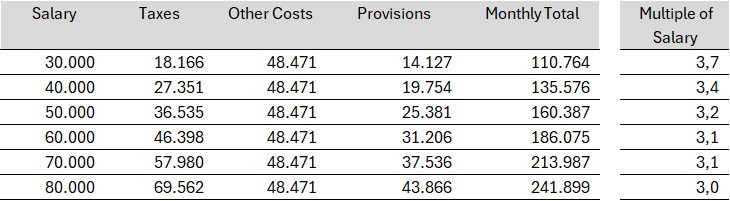

Below is the table prepared for other net wages, try to stay well with these costs 😊

Sales Team costs based on 2024 2nd half regulations

Then the question is how to optimize costs and be competent in the market. The answer is in Sellibles.

[…] Sellibles Blog. (2024) A realistic approach for calculating sales team’s costs for Turkish Market. Retrieved from https://sellibles.com/suppliers/employee-costs-for-turkish-market/ […]